In light of the time revolution to raise the retirement threshold, debate regarding retirement age assessment keeps swirling: the response fluttering between reactions of strong opposition and enthusiastic advocacy. Many Asian nations have formally raised questions in the realm of employment structures, particularly in the context of flexible working arrangements. The internal evidence requires many governments and pension companies to act constructively with regard to the decade of aging behavior at hand.

In this hearing, which will be heard in the premises of great debate, governments and corporations asserted their belief that lifelong employment and continuous support of their pension commitment genuinely demonstrate their commitment without the need for yet further increases in the pension value.

Several factors are driving discussions on the issue of raising the retirement age. First, more and more people, exceeding many in number indeed, are living for somewhat more than the number of years associated with the accepted retirement age, putting strain on the pension funds as well as social security systems. Second, shortages of labour in particular sectors underscored the need for experienced workers who could offer further valuable contributions post earlier retirement milestones. Third, a higher retirement age may offer more financial safety as well as lessen the chances of retirees running out of money later in life.

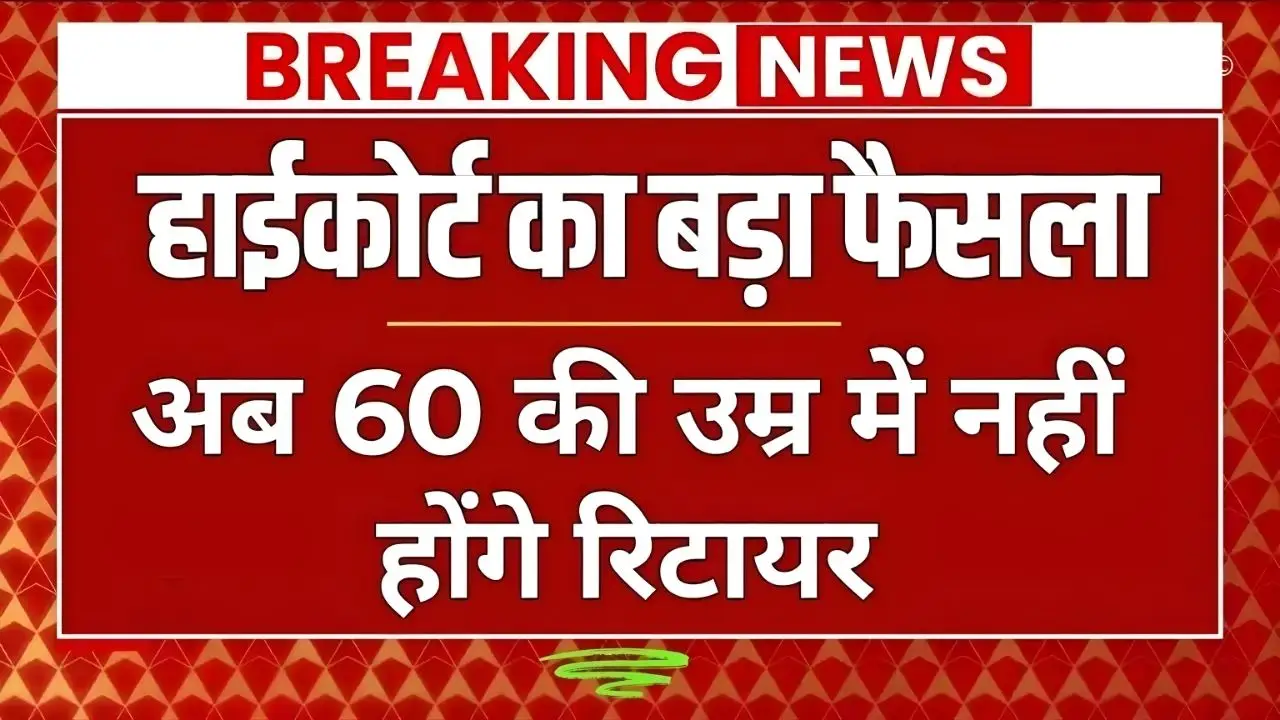

Pending Alterations by 2026

In 2026, the suggestions call for the slow and steady march upwards of the mandatory retirement age across the public and private sectors. The figure varies significantly from region to region or from one industry to another. However, the main stress has been placed on an increase in retirement age from the mid-60s to the late 60s and perhaps early 70s. The primary focus is to achieve a balance between retaining an aging workforce, where most of the workers are seen to be well experienced, and opening up as many opportunities as possible for the entry of young workers.

Impact on Pension and Retirement Planning

An increased retirement age may have significant effects on pension funds. This is because employees would have to contribute for longer periods towards the pension scheme, building higher accumulations of pension funds over years, with chances for a higher monthly payout ultimately. Longer contribution periods for pension trustees may alleviate funding pressures and help in the avoidance of their expected liabilities. Yet they do insist on an entire rearrangement of individuals’ long-term financial plannings as part of such increased work lives.

What Should Employees Know?

Affected workers about to retire are asked to stay informed about changes to retirement age policies and, as part of their considerations, should include updated retirement planning, possible new anticipated retirement dates and essentially any change concerning benefit eligibility. Financial advisors and employer HR departments are crucial for understanding the potential impacts on the personal planning of any changes.

Wider Economic Effects

Boosting retirement age can add to the economic growth by increasing labor female participation rate and reducing the dependency ratio an older workforce can bring institutional knowledge within a company. It should, however, properly address physical and health needs among older workers to produce an equitable outcome.

Summing Up

The updated Retirement Age Increase 2026 could wipe the slate clean, signaling a shift in avenues for our work and life, as more and more conversations are initiated and proposals crystallize into legislation, so both employees and employers should plan together for changes that redefine the traditional boundaries of the working-age sphere.