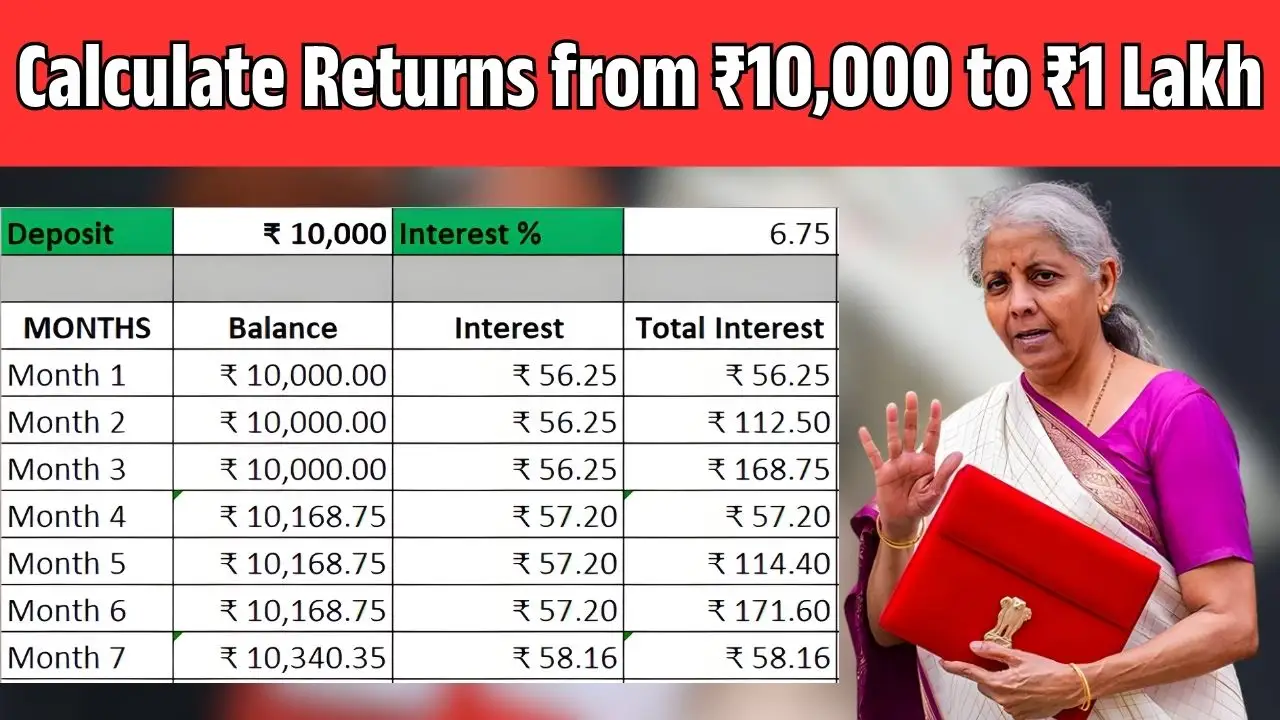

The rapid acquisition of wealth is generally seen as a tradeoff of colossal amounts of capital, but investing smartly has changed all that. An investment of as little as ₹10000 can swell into a substantial amount through smart investing in due course. When one grasps this compounding effect, one may set a target with rounded logic and decide upon the right investing path aimed at future milestones like ₹1,00,000 and so forth.

How Investment Grows: The Real Deal

This compounding takes place: investing gets you an income you don’t spend while still okaying one for an income! When one pocketed the gain and instead exercised the profit, experience; your mixture while keeping an ample portion for reinvestment as principal will compliment your good efforts.

The Time Value of an Investment of ₹10,000

Invest ₹10,000 at an average annual return of 8 percent to see it nearly double in about nine years; with investing and patience, the subsequent growth of the amount is maintained at a relatively low but steady rate. Returns of this kind are usually associated with high-risk investment options with some moderate long-term stability.

Common Sense Shortcuts: Whether Investing ₹1 Lakh in One Shot vs. ₹10,000 vs.:

This is because to reach ₹1 lakh faster, higher returns or repeated investments necessitate entering the picture. On the same investments, a return of 12-15 percent, which can be garnered through long-term equity-oriented investments, is expected to push the amount up expertly several times over one and a half decades or somewhat shorter, provided one stays invested during ups and downs without letting careful thinking drive a sell-off.

Power of Regular Contributions

Contributing money over time is the gateway to accelerated growth. Contributing an amount consistently in small volumes can go a long way to bump the final value up. Even a small step can cut time when conjoined with compounding.

Importance of Time and Patience

Short term expectations mostly lead to disappointment, but long-term investing pays back its rewards to the patient ones. The greatest beneficiaries will be those investors allowing their investments to grow for many years in which case frequent wihdrawal avoidance and a little bit of time given to investments to mature can give birth to returns.

Final Thoughts

The combination of time, discipline, and return expectations can convert ₹10,000 to $100,000. As no investment can guarantee exact outcomes, the understanding of how returns multiply allows the investor to make informed decisions and build wealth through time.