In 2026, post office fixed deposits have continued to be a sought-after saving option, particularly for risk-averse investors and the elderly. The benefit of these deposits is their guarantee and backings. The Post Office FD calculator 2026 has made it very easy for one to compute on the maturity amount instantly and make his/her financial planning with a sure sense of security.

What Is the Post Office FD Scheme?

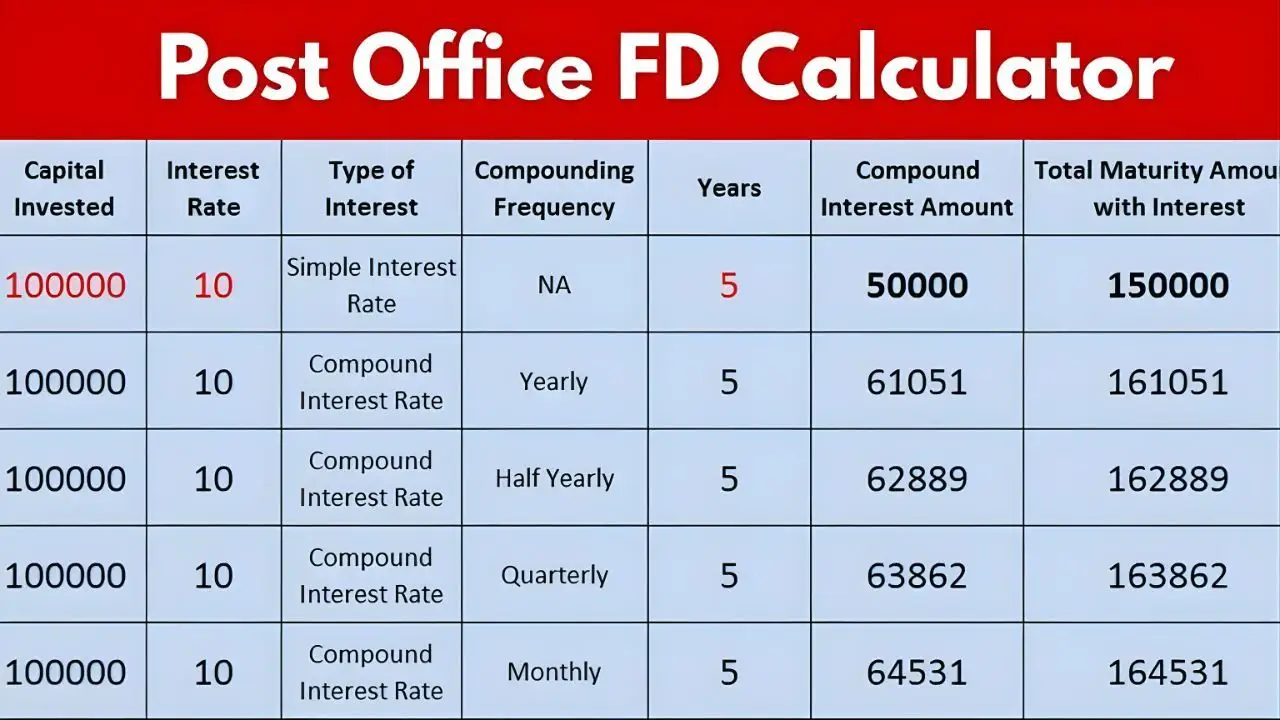

The Post Office Fixed Deposit scheme involves people investing a lump sum for a fixed term and earning interest thereupon. In 2026, depositors can expect various tenure options starting from generally one year up to about five years. In such a case, the interest becomes payable at maturity with annual compounding, which makes this kind of investment a safe and predictable option.

How Does the FD Calculator Help Investors?

Post Office FD Calculator is intended to provide quick and accurate estimations for the maturity amounts. With an input of a deposited sum, the selected tenure and the interest rate adjusted with a click of a button, it immediately demonstrates how much the depositor will get back. It aids in estimating without imposing guesswork and breeks down the comparison among various tenures that may be under consideration.

Maturity Amount Calculaton

The ultimate return upon maturity centers around three main pillars: the invested amount, the interest rate that is prevalent for the tenure, and the date of the deposit. Even a slightly smaller tenure would mean a lot in terms of returns that are expected out of the power of compounding. With the help of the calculator, individuals will be able to know where they will put in cash for shorter or more extended periods.

Why Use A Calculator In 2026?

Calculators have been a must-have instrument since the time of interest rate change and enhanced financial literacy. In 2026, there is a greater focus on certainty in lieu of estimation. The calculator ensures that FDs stick to the purpose and benefit choice of reason, such as educational expenses, retirement savings, emergency funds.

Optimal for Senior Citizens and Conservative Investors

Post office FDs have become the best choice for senior citizens due to the safety, security, and predictable return they offer. The calculator helps retirees figure out the maturity proceeds accurately so as to finance future expenses much more comfortably. Another example of how the calculator gives a clearer picture to investors is in the case of conservative investors.

In Conclusion

Thus, the calculator can simplify the manner of preparing the portfolio for investment to return; this is because no one has the time to sit, calculate, and do projections-let the calculator do the work for everyone. Knowing the exact maturity value, whether it is a small or large amount, helps facilitate better decision-making with a lot of trust in the decisions made by the investor.